Refinancing Marketplace

Employees can unlock better loans when they know the best options

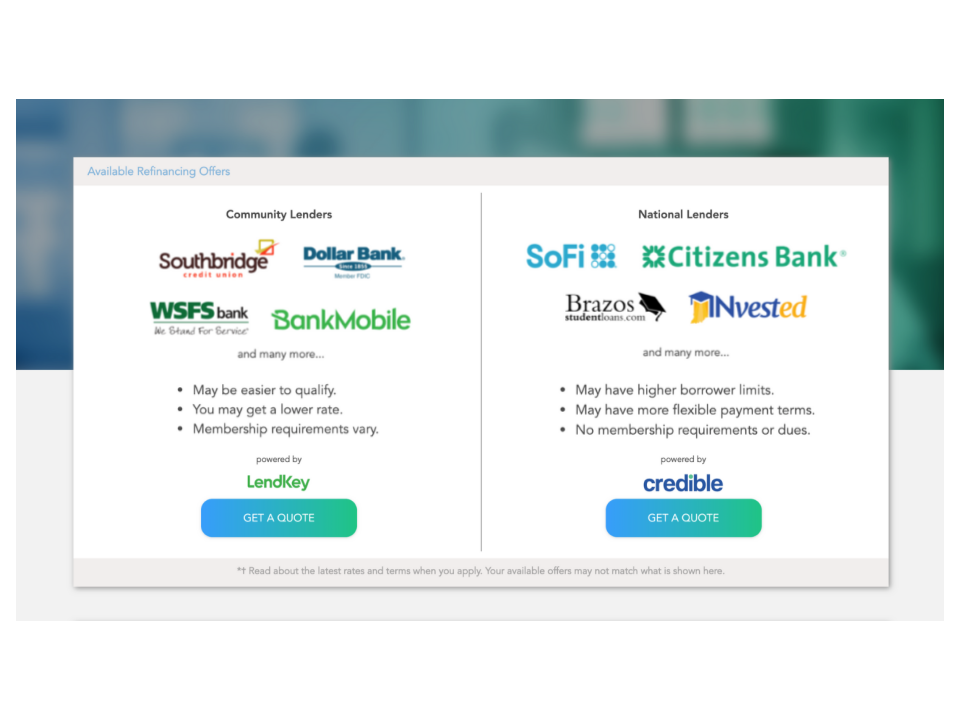

The marketplace gives employees easy access to lender options

Discover Lender Options

We make lenders compete so borrowers get a great deal.

- Get quoted in minutes

- See rates without a hard credit pull

- Access more than 20 national and community lenders

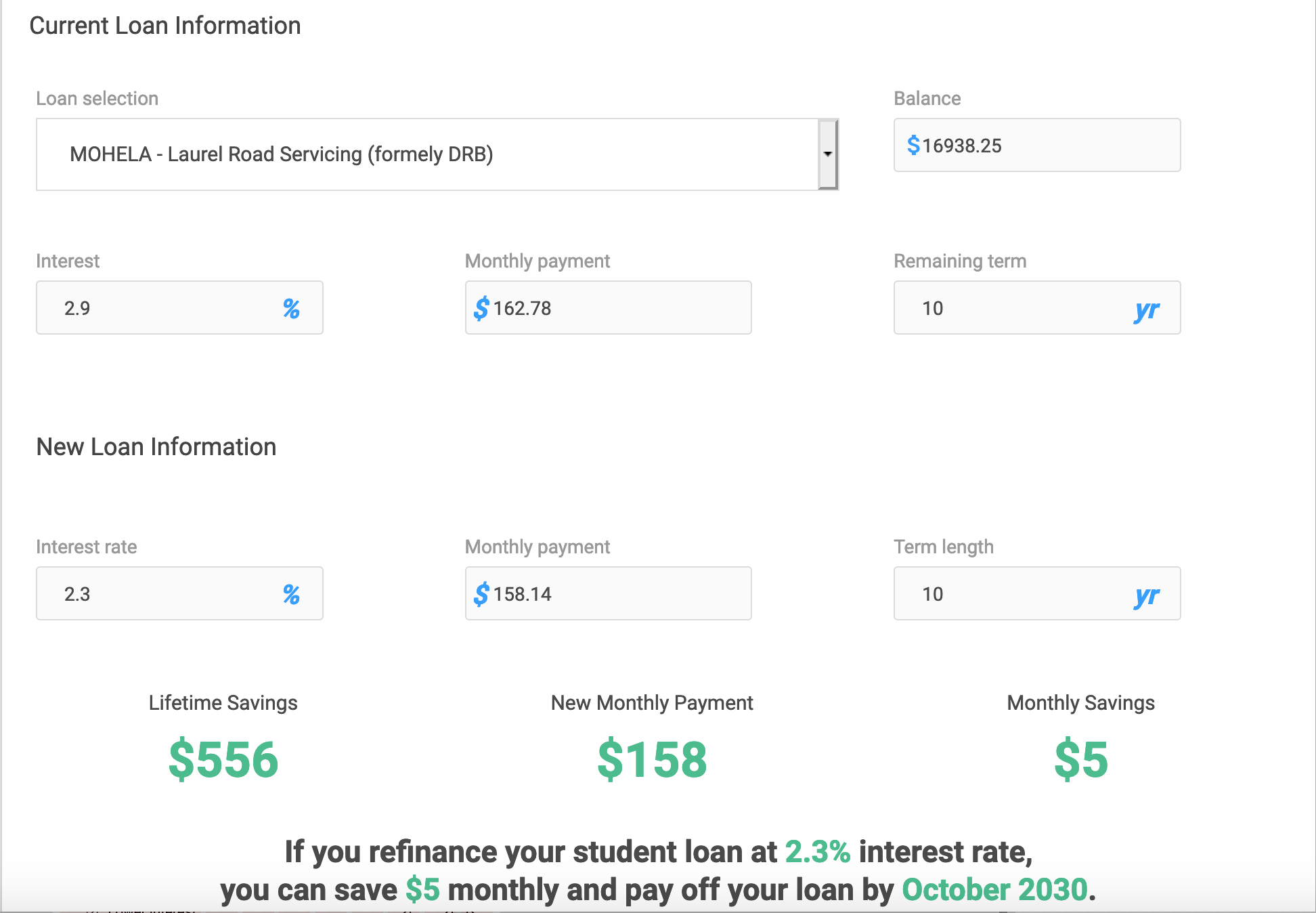

Project Refinancing Savings

We show employees what their potential short- and long-term savings could be with refinancing in place.

- Estimate the rate and terms of their new loan

- Gain a better sense of how a new rate could positively impact their loan balance

What is refinancing?

Student loan refinancing is the process of acquiring a new student loan at a potentially lower interest rate. If your employees choose to refinance, a new student loan lender will buy out their existing loans and provide them with a single new loan. Refinancing can help lower interest as well as monthly payments, and could potentially save them a ton of money. Peanut Butter works with multiple lenders to get you the best deal.

and many more.

What’s the value for your employees?

Lower Interest

Potential to Save Money

Lower Monthly Payments

Employees are seeing results

“Peanut Butter helped me get out of debt faster so that I could save more money and allocate it to other things”

Employees receive the Refinancing Marketplace when their employer provides one of these solutions:

Repayment

Resources

Refinancing