Student Loan Resources

Help your employees take control of their student debt.

Student debt is confusing.

There are 45 million Americans with more than $1.5 trillion in student loans and 70% don’t know how to find out if they could pay less.

Empower your employees with Student Loan Resources.

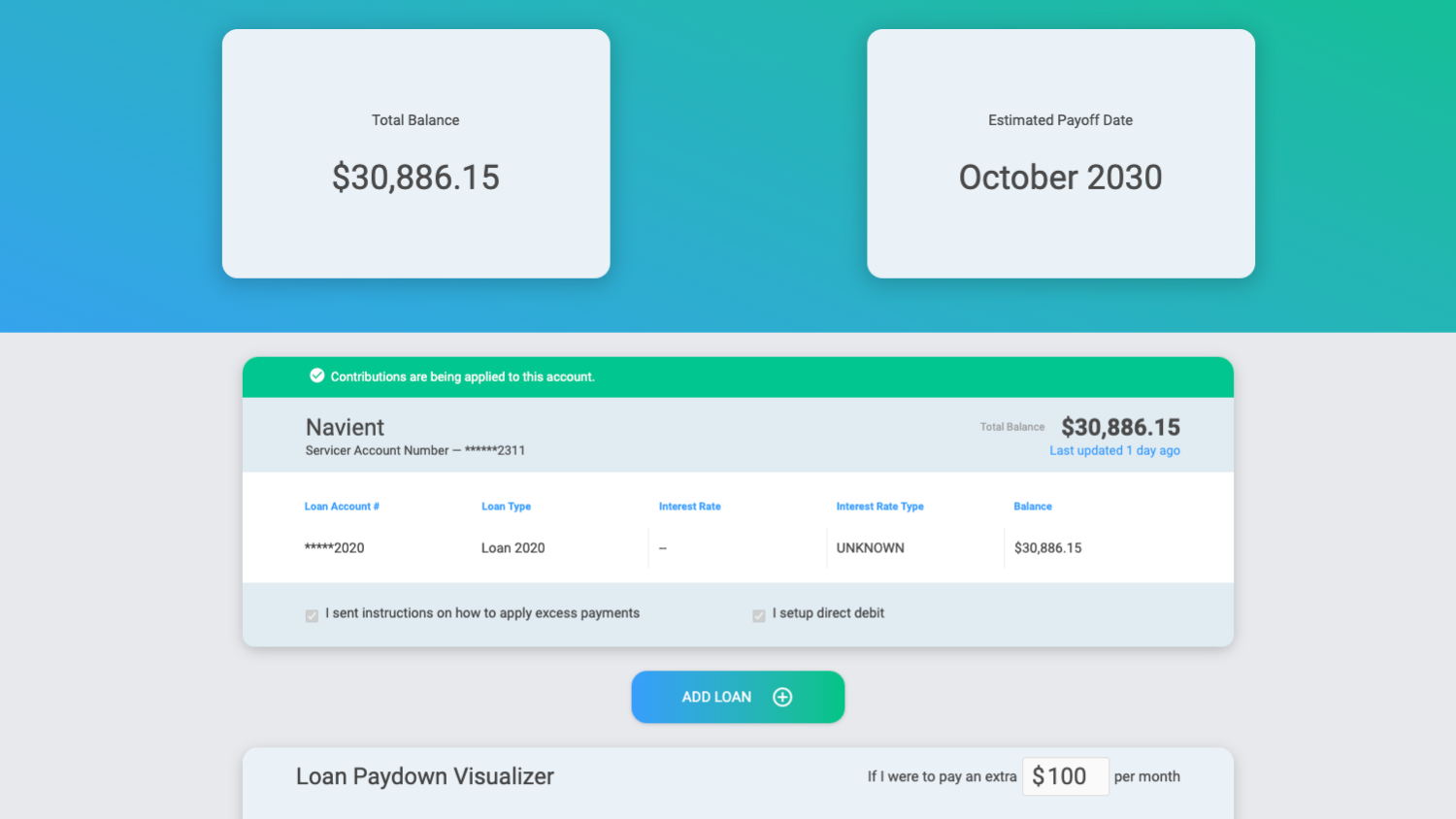

Loan Management Dashboard

Organize their loans and view up-to-date information.

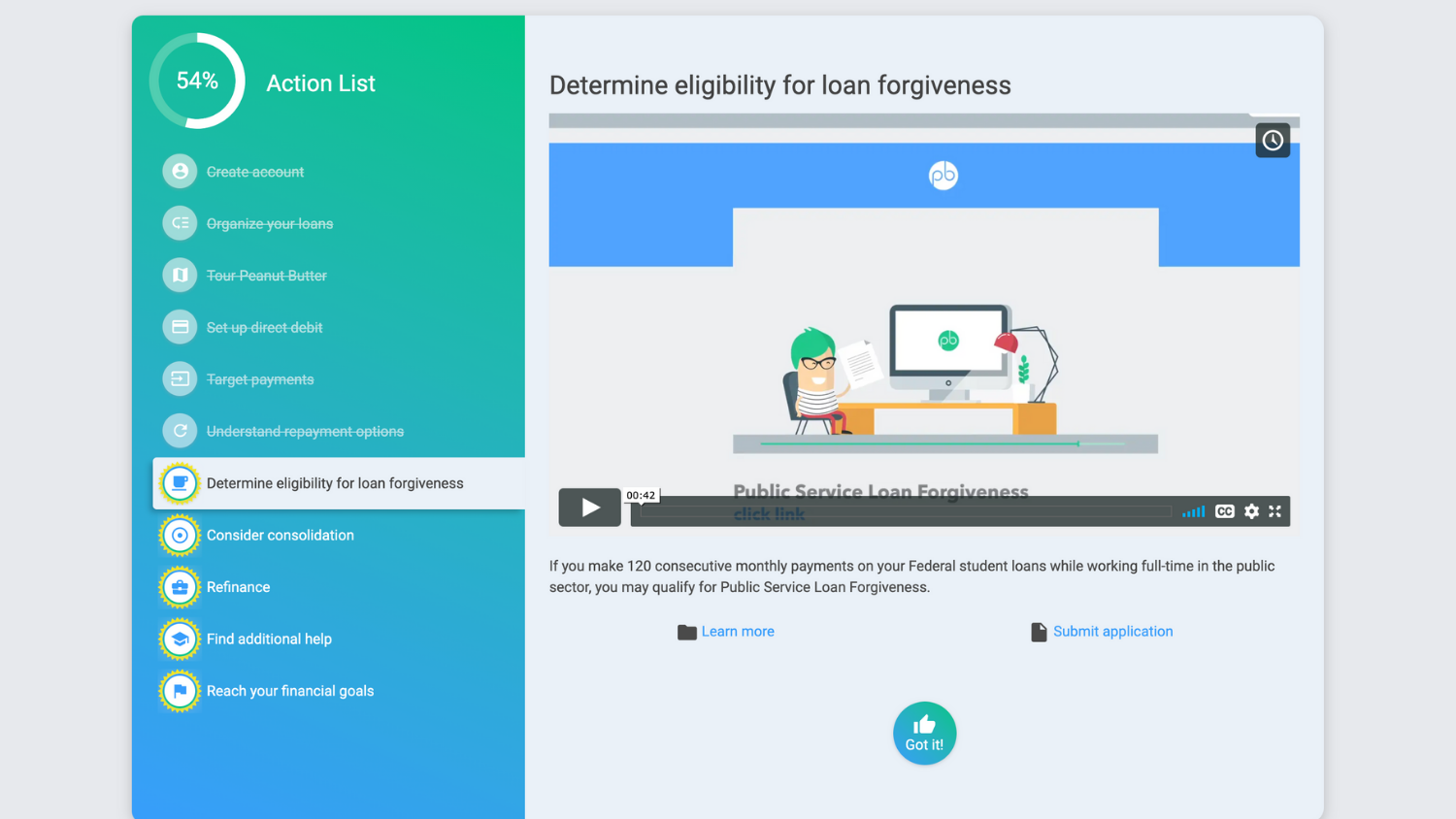

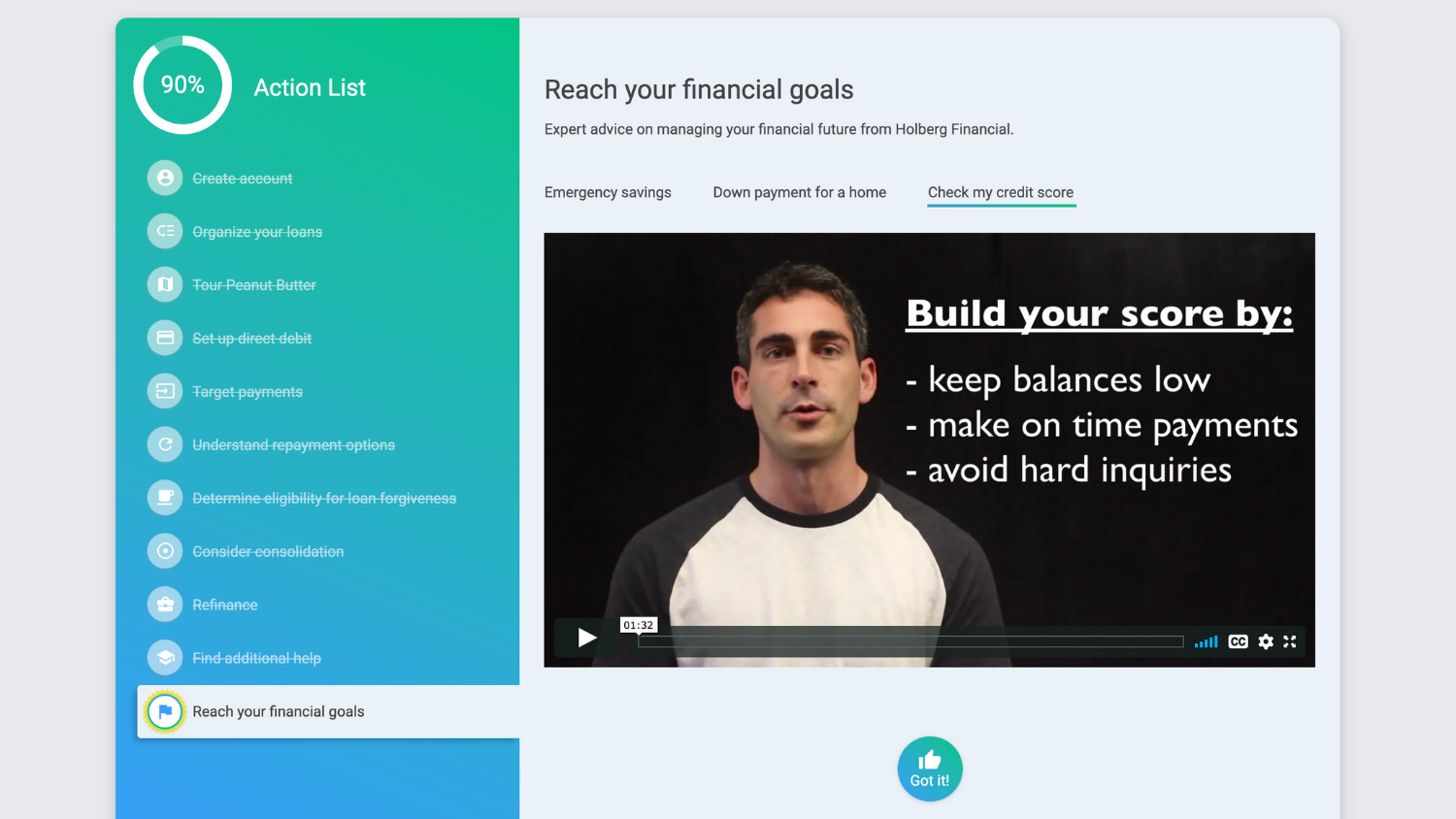

Curated Advice + Insights

Identify and implement money-saving tactics.

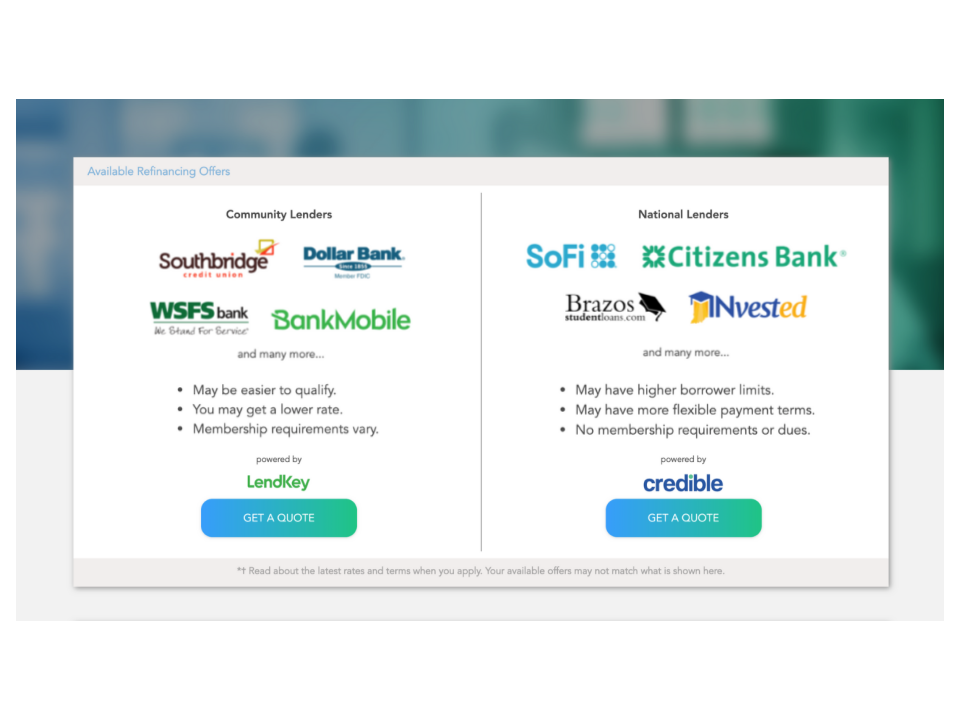

Refinancing Marketplace

We made lenders compete so borrowers get a great deal:

- Get quoted in minutes

- See rates without a hard credit pull

- Access more than 20 national and community lenders

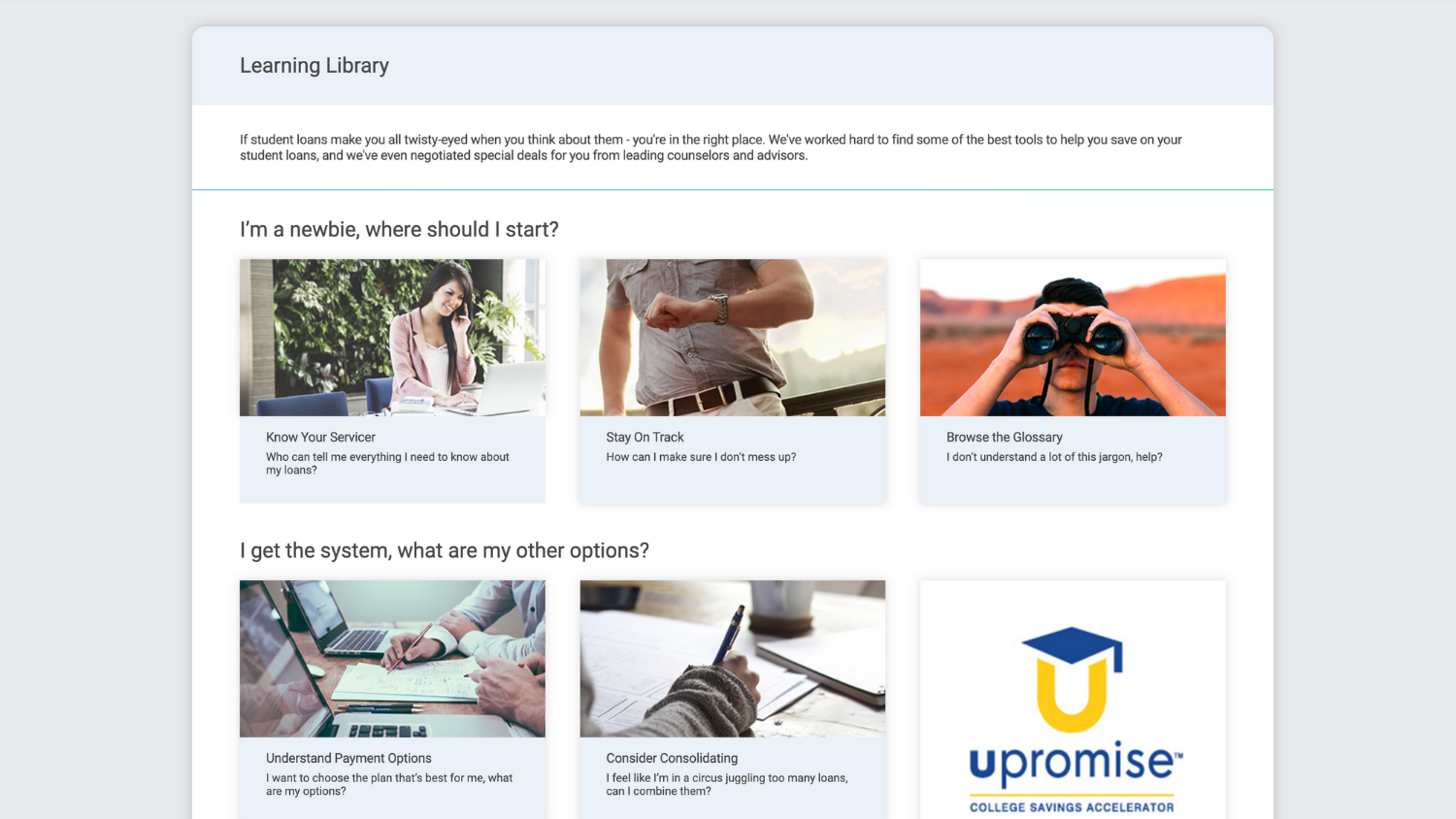

Financial Wellness Tools

Our library helps borrowers understand student debt:

- Federal and private loan guidelines

- Payment options, consolidation, and government programs

- Special offers and discounts

Debt Counseling Options

Curated portal of free services and preferred rates from paid advisors.

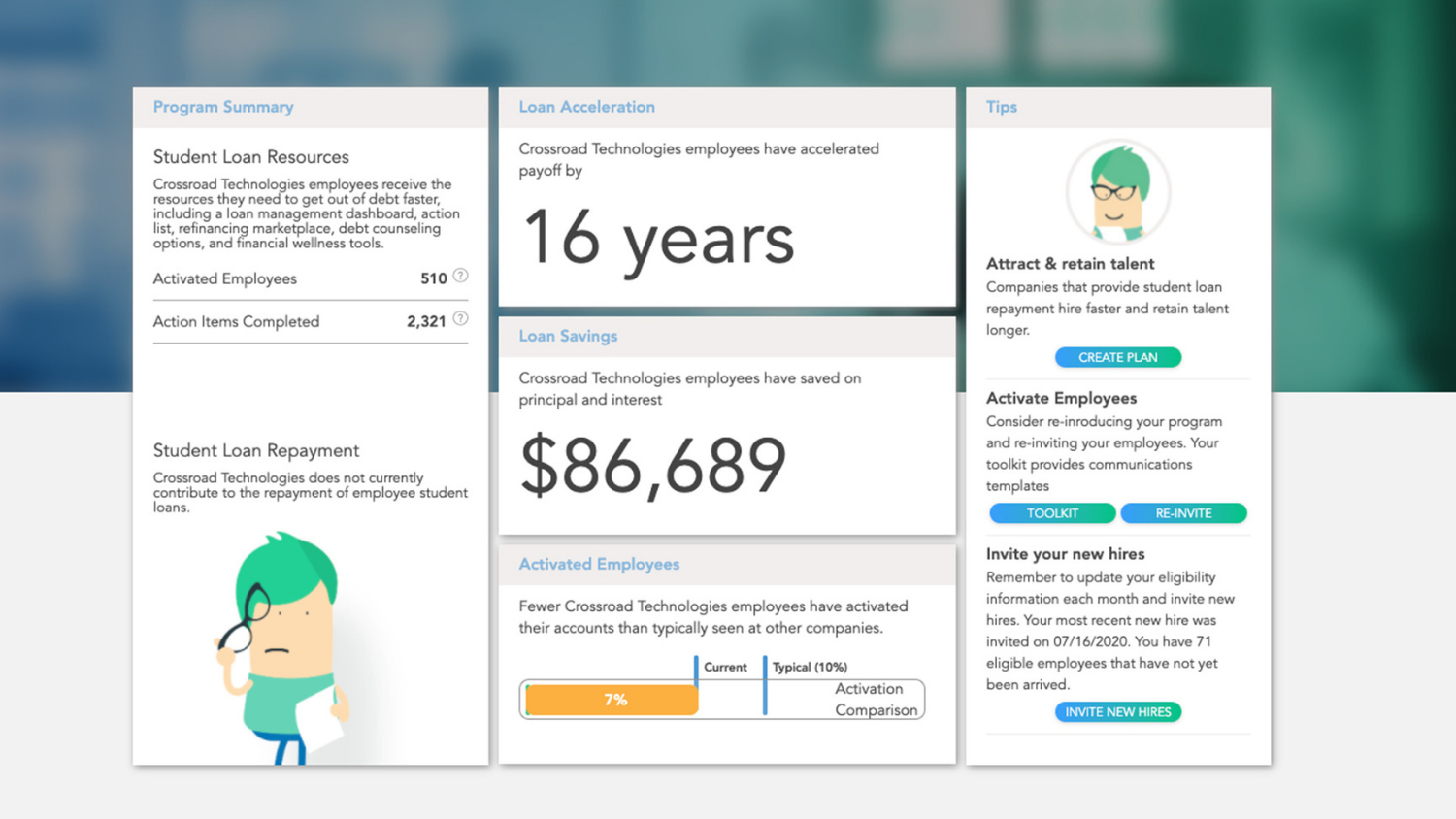

Administer your company’s program with ease.

Employer Control Panel

Kick-off program in minutes and maintain secure access to on-demand reporting.

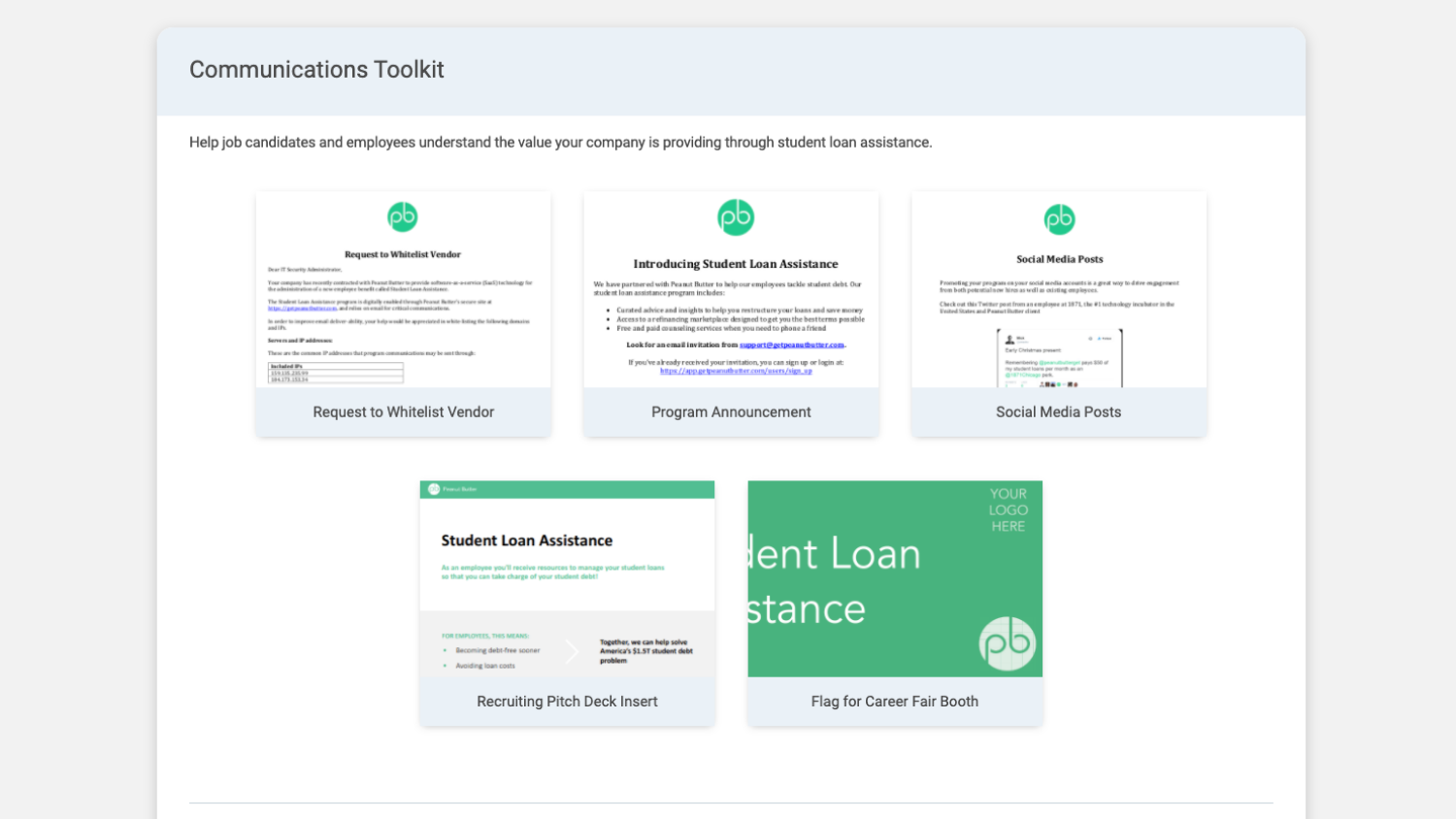

Communications Toolkit

Tried-and-trusted templates to announce your program and communicate its merits to employees.

HR Support

Your assigned Customer Success Manager will support your HR team on program administration, communication and plan design.

Easily upgrade anytime.

Student Loan Repayment

Provide loan contributions to improve hiring and retention of talent

Prioritize financial wellness

Be relevant to a modern workforce

Make a difference

Learn more about Student Loan Resources.

Employers & employees win with Student Loan Resources.

Help your teammates tackle student debt.