FREQUENTLY ASKED QUESTIONS

Jump to an FAQ section:

Learn more about Peanut Butter Student Loan Assistance

Why is the company called Peanut Butter?

For a lot of people, peanut butter is the only thing they can afford to eat in college.

It’s our honor to pay homage to the hard work and sacrifice that many endured to earn their degree and become qualified for great jobs with our clients.

What did you eat in college?

What is Student Loan Assistance?

Student Loan Assistance is the #1 benefit preferred by college-educated talent. It helps employers achieve their talent acquisition and retention goals by:

- providing employees with online resources to manage their student debt, and

- providing employers with a convenient way to make monthly contributions to the employees’ student loans.

Why are employers choosing to offer Student Loan Assistance?

Employers are choosing to offer Student Loan Assistance in order to attract, retain, and engage a diverse set of the most ambitious and well-trained workers in the world. Learn more here.

What other employers offer student loan assistance?

The Society for Human Resources Management (SHRM) reported that 8% of US employers offer Student Loan Repayment in 2019, up 100% year over year. EBRI recently reported that nearly 1/3 of US employers offer some form of Student Loan Assistance, like Student Loan Resources, or have plans to do so. See the stats here.

Peanut Butter is proud to partner employers across the United States, including many in these industries.

How does Peanut Butter administer a Student Loan Assistance program?

Peanut Butter provides software and support services that make it easy for employers offer Student Loan Assistance as a benefit. Peanut Butter supports various levels of Student Loan Assistance. To pick the plan that’s right for your company, click here.

How much does Peanut Butter cost?

Most companies choose to offer Student Loan Repayment which has two associated fees:

- Annual platform fee

- Monthly participatory fee

Some companies will choose to offer Student Loan Resources which only includes an annual platform fee.

To pick the plan that’s right for your company, click here.

What are the employer's responsibilities?

With Peanut Butter’s SaaS solution for Student Loan Assistance, employers typically spend an hour setting up their program and they’ll have one person spend about 20 minutes per month on program administration. The employer’s primary administrator is typically an in-house employee responsible for payroll administration, benefits admin, or serving as an HR Generalist.

What should employers keep in mind when designing their plans?

These three rules of thumb can help your company build an effective program:

- Start low and grow. Instead of a large contribution, start your program with a smaller monthly contribution then look to increase it in the second plan year.

- Keep it simple. Make the program available to all full-time employees, just like most companies offer health insurance.

- Have shared accountability. Make employees responsible for their minimum monthly contributions while your company’s contributions help them get out of debt faster.

How much do employers typically contribute?

The most common company contribution — across industries and geographies — is $50 per month.

When an employer contributes $50 per month, the average employee will get out of debt in 8 years instead of 10 and save nearly $7,000 in principal and interest.

If your employees are located in an area with a high cost of living (e.g., Los Angeles, San Francisco, New York City) or if many of your employees hold advanced degrees (e.g., JD, DDS, DVM, MS, MA) your company may want to consider a $100 monthly contribution.

On the lower end, we see some companies offer the benefit effectively with a $30 monthly contribution.

Do employers typically cap their total student loan contributions?

No. Most companies contribute until the employee’s student loans are fully paid off. The logic here is that the company is making a wise (and modest investment) several years down the road if its $50 contribution is continuing to incentive a long-term employee to stay. Beyond the financial return, many employers like to be a part of the employee’s magic moment of becoming student debt-free.

Do employers typically offer tiered plans that increase over time?

While Peanut Butter offers the option for Tiered plans, most successful plans keep it simple offering a flat dollar amount.

A modest contribution can make a noticeable difference in achieving hiring and retention goals. It also minimizes the company’s financial risk while you assess how many employees will elect to participate in the benefit.

How are employer contributions taxed?

As you may have assumed, your company’s contributions to student loans will be tax-deductible as a business expense, just like its other salary, wage, and benefit costs.

And, just like compensation your contributions to student loans will be taxable (learn more here) on payroll, but if your company adopts a 127 plan, you can contribute tax-free (learn more here).

Can companies offer employees the option to receive either 401(k) contributions or Student Loan Assistance?

No, because ERISA laws will not currently allow employers to make 401(k) participation or contributions contingent on action or inaction.

Learn more by reading our blog article “Three Things to Consider If Attempting to Tie Student Loan Repayment and a Company 401(K)“.

How do companies typically determine eligibility?

Most employers choose to offer Student Loan Assistance to all full-time benefit-eligible employees.

However, employers have the option to offer Student Loan Assistance to a subset of employees and not to other employees, or extend it more broadly and include part-time employees.

What eligibility criteria can be used?

Is there any eligibility criteria not recommended?

We recommend against the following restrictive eligibility criteria:

- Salary (e.g., above or below a threshold)

- Degree requirements (i.e., must have attained a bachelor’s degree)

These requirements can cause unnecessary aggravation and confusion among employees.

Are employee spouses eligible to participate?

No, your employee must be listed as the primary borrower on the student loan in order to qualify for Student Loan Repayment. Read our blog article “This Is Why Your Employee Should Always Be the Borrower When You Offer Student Loan Repayment” to understand more. That said, many employees use the My Loans page and the Action List to organize and manage student loans for family members.

Who is likely to participate?

Employees with student loans are likely to participate and employees without student loans are likely to decline participation. This is similar to other benefits.

How many of my employees have student loans?

About 26% of those employed in the U.S. workforce hold student debt. Accordingly, most employers will see about a quarter of their workforce elect to participate in a Student Loan Repayment plan.

To learn more about how student debt affects workers in your industry, click here.

Should our program include a claw-back provision?

With some benefit programs, employers pay out a large benefit up front, then require the employee to stay with the company for a number of years.

This is not necessary with Student Loan Repayment since the amounts are typically small (i.e., $50/month) and the employee only receives a contribution each month when she stays with the company.

What do employees agree to do as participants in the program?

Employees that elect to participate in a student loan repayment plan agree to:

- Meet the eligibility criteria for the program, as defined by their employer,

- Submit a qualified student loan in good standing, with a balance, in their name as the borrower, and [if part of a 127 plan] taken out for their education only,

- Continue making at least their minimum monthly student loan payment each month,

- Abide by Peanut Butter’s full Terms of Use and acknowledge receipt of its Privacy Policy, and

- Maintain compliance with all company employment and benefit policies, including if applicable, the company’s 127 plan.

What types of loans qualify when the company offers a tax-free plan?

Federal and private student loans qualify for tax-free contributions under a section 127 Student Loan Repayment plan so long as the loan was taken out for the employee’s own college tuition and related expenses. These loan types include:

- Direct Subsidized, Unsubsidized, Consolidation, and Grad Plus loans

- Stafford Subsidized, Unsubsidized, Consolidation, and Plus loans

- Perkins Loans

- Private Student Loans

Unfortunately, other loans do not qualify for participation in 127 plans. These loan types include:

- Direct Parent Plus loans that were taken out for the benefit of a dependent (i.e., not the employee)

- Private parent loans that were taken out for the benefit of a dependent (i.e., not the employee)

- Student loans guaranteed or serviced by non-U.S. entities

- Co-signed loans, or any other loan where the employee is not the primary borrower on the loan

- Any non-student loan such as a personal loan, home equity loan, credit card, or other revolving debt facilities

- Defaulted loans that have been turned over to a collection agency

What types of loans qualify when the company offers a taxable plan?

A broad range of federal, private, and ex-US student loans qualify for contributions under taxable a student loan repayment plan unless specifically precluded by the employer’s policy. These loan types include:

- Direct Subsidized, Unsubsidized, Consolidation, and Grad Plus loans

- Stafford Subsidized, Unsubsidized, Consolidation, and Plus loans

- Perkins Loans

- Private Student Loans

- Direct Parent Plus loans

- Private parent loans

- Student loans guaranteed, or serviced by, non-U.S. entities

Some loans do not qualify for taxable student loan repayment. These loan types include:

- Co-signed loans, or any other loan where the employee is not the primary borrower on the loan

- Any non-student loan such as a personal loan, home equity loan, credit card, or other revolving debt facilities

- Defaulted loans that have been turned over to a collection agency

Which loan servicers does Peanut Butter work with?

- FedLoan

- Navient

- Aidvantage (a division of Maximus)

- Great Lakes

- Nelnet

- Missouri Higher Education Loan Authority (MOHELA)

- EdFinancial Services

- Firstmark Services (a division of Nelnet)

- Oklahoma Student Loan Authority (OSLA)

- American Education Services (AES)

- Sallie Mae

- Earnest (a division of Navient)

- Discover Student Loans (DSL)

- Granite State Management & Resources (GSMR)

- Lendkey

- University Accounting Services

- Heartland ECSI

- Mountain America CU

- Aspire Resources

- Utah Higher Education Assistance Authority

- PenFed

- Bank of North Dakota

- New Jersey Higher Education Student Assistance Authority (HESAA)

- First Republic Bank

- College Foundation, Inc.

- Texas Higher Education Coordinating Board

- Kentucky Higher Education Student Loan Corporation

- Launch Servicing

- And more

How does loan verification work?

When an employee elects to participate in her company’s student loan repayment plan, she will agree to comply with Peanut Butter’s Terms of Use, acknowledge Peanut Butter’s Privacy Policy, agree to comply with all of her company’s benefits policies including, if applicable, it’s Section 127 Educational Assistance Plan, and she will provide information about her student loan so that Peanut Butter can confirm that the:

- Loan type is a student loan

- Borrower’s first name is the same as the employee’s first name

- Loan is in good standing and able to receive payment

- Payment details are complete

- Balance is greater than $0

Can I start offering this today? What is the implementation timeline?

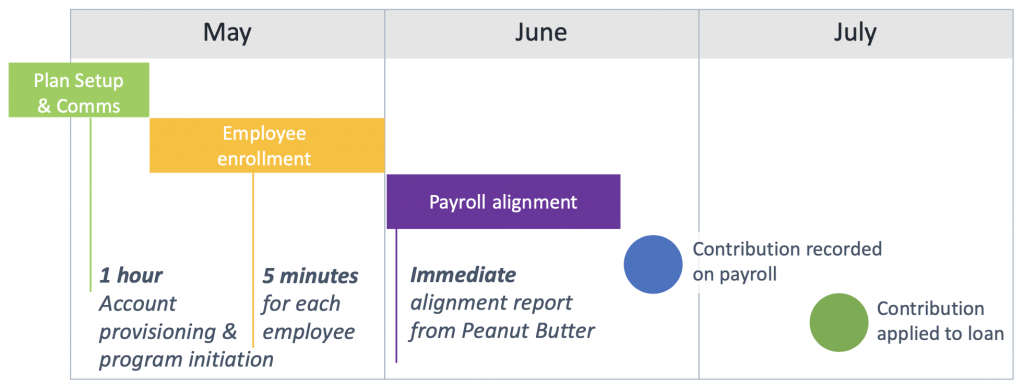

Yes! Your company’s plan can be setup and communicated to employees in under an hour. Here’s an example of a full enrollment timeline.

Should we conduct enrollment at the same time as our health plan enrollment?

How do I know the eligible employee is making their monthly payment?

Are payments applied to my employee's principal balance?

Employer-sponsored contributions are applied according to the terms of the employee’s loan agreement with the lender and/or loan servicer. We also provide guidance to employees in their account on ways to communicate with their loan servicer and request excess payments be applied to principal when possible.

Do you integrate with payroll?

In some cases, we do. For example, standard integrations are offered through ADP if requested.

Most employers that offer this benefit do not require a payroll integration. Monthly administration of the program takes most employers half an hour or less.

Should we process employee payments via payroll?

No, definitely not. If your employees went to college, they probably have bank accounts that offer online bill pay. Your company would provide no utility to its employees by deducting their minimum student loan payments from their paychecks, and your company would take on undue liability related to the employee’s loan, payment timing, penalties, and interest.