by David Aronson | Aug 15, 2017 | Press Room

Plan design drives success in all employee benefits. Participants at this year’s EBN Benefits Forum & Expo in Boca Raton, Florida, will learn about the right questions to ask, and the benchmarks to know, in order to design a Student Loan Assistance program...

by David Aronson | Aug 15, 2017 | Press Room

One of North America’s largest financial institutions has selected Peanut Butter for its exclusive FinTech partnership program. BMO Harris, a division of Bank of Montreal, holds more than $500 billion in assets and operates one of the largest commercial and...

by David Aronson | Jun 5, 2017 | Insights

For most employers, there is no need to implement a holding period. Student Loan Assistance is a strong recruiting tool and the impact is maximized if newly hired employees start receiving employer contributions from day one. There are of course exceptions to the...

by David Aronson | May 17, 2017 | Insights

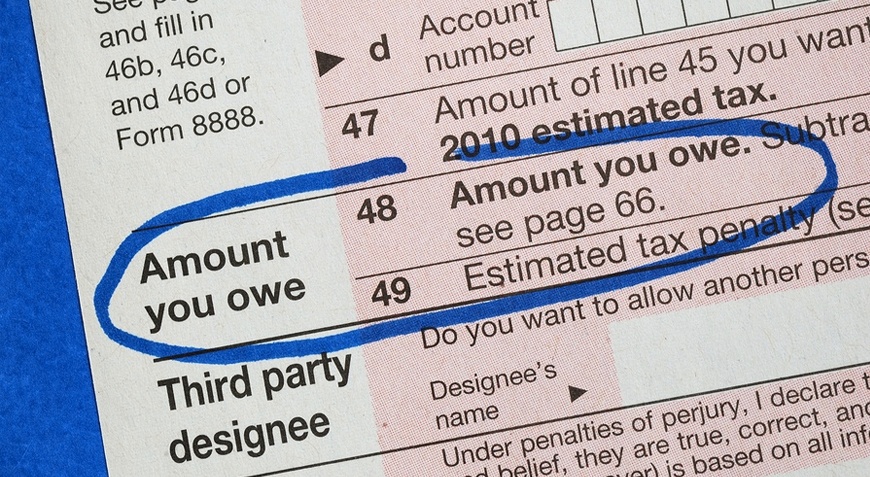

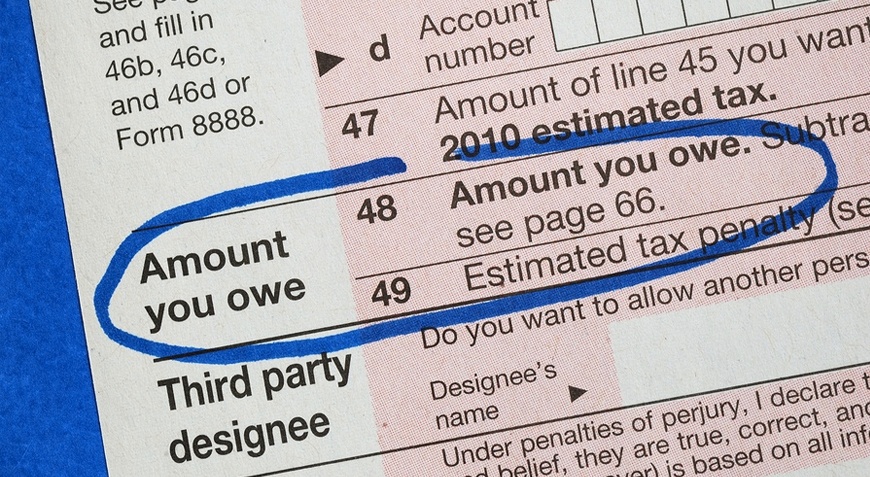

Good news: employer-sponsored student loan repayment contributions are tax deductible. An easy way to think of student loan repayment is to consider it like compensation. That means employers can deduct their contributions as a business expense like they do with...

by David Aronson | May 9, 2017 | Insights

While this may seem like a value-add service to some, the reality is that your employees don’t need this, it creates unnecessary complexity for your program and in some cases may introduce financial liability. Though technically possible, we advise employers to...

by David Aronson | May 4, 2017 | Insights

Clawback provisions are common with tuition reimbursement, so this question comes up a lot. Because of some key differences in how we administer student loan repayment, there is usually not a need to have this type of provision attached to your program. Employer...