How to attract, retain and engage college-educated workers

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (H.R. 748, “CARES Act”, specifically Sec. 2206(B)) made it possible for companies to pay down their employees’ student loans tax-free.

Subsequently, Peanut Butter CEO David Aronson hosted a webinar on how employers can contribute to student loans tax-free in order to attract, retain and engage college-educated talent, even and especially in the midst of the coronavirus pandemic.

Since 2015, leading employers across the U.S. have looked to Peanut Butter to administer Student Loan Assistance programs. Peanut Butter’s comprehensive platform provides employees with the resources to manage their student loans, and helps companies contribute to the repayment of student debt. Its services include Student Loan Resources and Student Loan Repayment.

The webinar focused on five areas of interest:

I. CARES Act allows employers to contribute to student loans tax-free

II. Tax treatment of employer contributions to student loans

III. How Student Loan Assistance helps employers attract and retain college-educated workers

IV. Student Loan Assistance program design considerations and FAQs

V. Peanut Butter makes it easy for employers to offer Student Loan Assistance

I. CARES Act allows employers to contribute to student loans tax-free

As part of the CARES Act, employers can contribute to employees’ student loans on a tax-free basis. Effectively:

- Employers can now make contributions to employees’ student loans through a Section 127 Educational Assistance plan, and thereby,

- Company contributions to student loans may be excluded from the employee’s gross income up to a maximum of $5,250 per year for payments recorded on payroll up to and including December 31, 2020.

Section 2206(B) of the CARES Act was adopted verbatim from the Employer Participation in Repayment Act (H.R. 1043/S. 460). Each of these bills has been referred to committee and each currently has co-sponsorship from a bipartisan set of members, collectively representing over 60% of each chamber of Congress. It is Peanut Butter’s opinion that the bicameral, bipartisan, majority support from Congress indicates a high likelihood that the tax-free treatment of employer-sponsored student loan contributions will be extended beyond 2020.

II. Tax treatment of employer contributions to student loans

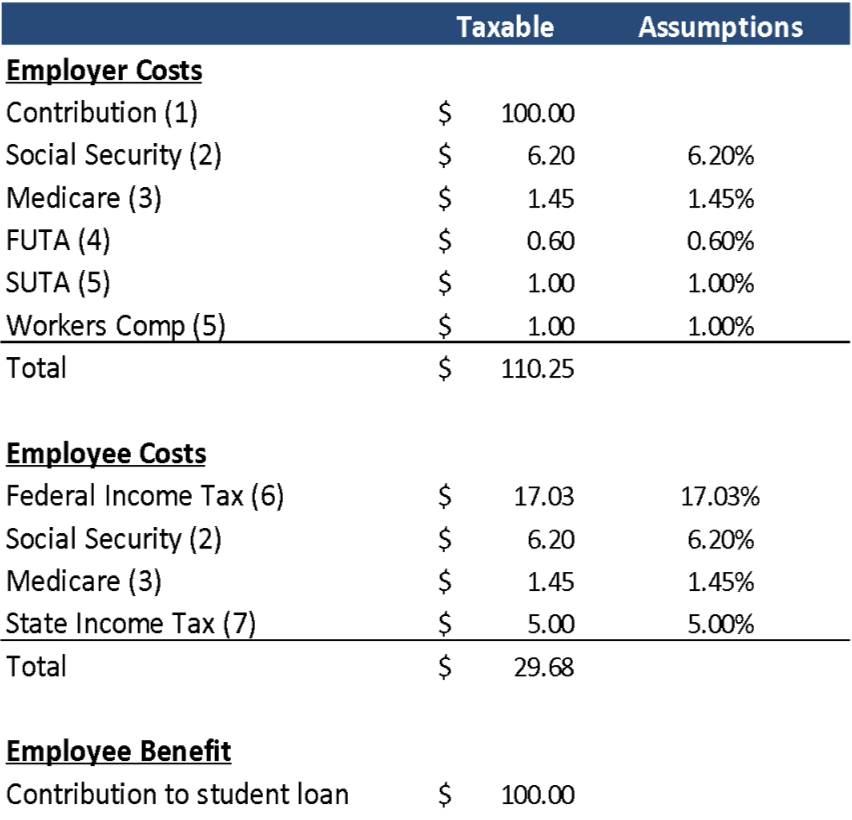

There is a significant difference in the cost of taxable and tax-free Student Loan Repayment.

Taxable: Before the CARES Act became law, employer contributions to student loans were added to the employee’s gross income and were therefore taxable. This will remain the case for companies that offer Student Loan Repayment and choose not to adopt a Section 127 plan.

Let’s look at the employer and employee costs when an employer contributes (or before the CARES Act, contributed) to student loans outside of a Section 127 plan:

On the employer side of the ledger, when the company contributes $100.00, their payroll system withholds $6.20 for Social Security, $1.45 for Medicare, $0.60 for Federal Unemployment Tax, ~$1.00 for State Unemployment Tax (depending on the employer’s rate), and likely some funds for Workers Compensation (for companies on a pay-as-you-go plan).

On the employee side, the company’s payroll system also withholds taxes.

For employees, the largest tax withheld is Federal Income Tax. The company’s payroll system also withholds Social Security, Medicare, and State Income Tax (if applicable).

When an employer contributed (before the CARES Act) or contributes (in the future) to student loans outside of a Section 127 plan:

- The employer incurs the cost of its contribution along with a payroll tax burden of approximately 10%, and

- An employee that elects to participate in the program receives the company’s contribution into her/his student loan, but incurs an income tax burden of approximately 30%.

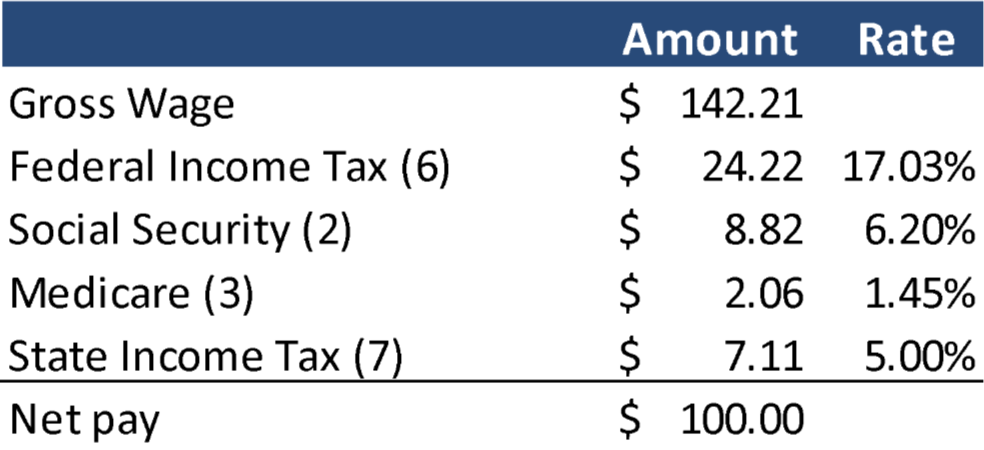

Assumptions: (1) annual limit $5,250, (2) applied to first $137,700 gross wages, (3) increases to 2.35% above $200,000, (4) varies with state credits, paid on first $7,000 gross wages, (5) varies with employer experience, (6) based on 2020 federal tax table for individual with gross earnings of $83,370, (7) varies by state.

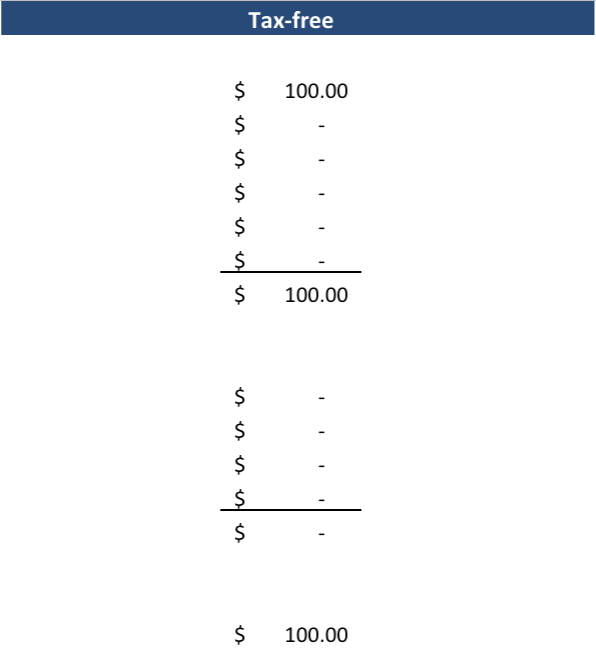

Tax-free: Since the CARES Act became law, employers that contribute to student loans through a Section 127 plan may exclude those contributions from the employee’s gross income.

Let’s look at the employer and employee costs when an employer contributes to student loans through a Section 127 plan:

On the employer side of the ledger, when the company contributes $100.00, there is no withholding for Social Security, Medicare, Federal Unemployment Tax, State Unemployment Tax or Workers Compensation.

On the employee side, there is no withholding for Federal Income Tax, Social Security, Medicare, or State Income Tax (if applicable).

Now, when an employer contributes to student loans through a Section 127 plan:

- The employer incurs the cost of its contribution, and

- An employee that elects to participate in the program receives the company’s contribution into her/his student loan.

- Effectively, the employer saves about 10% on payroll taxes and the employee saves about 30% on income taxes.

Employees are unable to contribute tax-free: Although employers may now contribute to student loans tax-free, employees cannot. The tax code states that “To qualify under Section 127, a program must not provide eligible employees with a choice between educational assistance benefits and any other taxable compensation (whether cash or non-cash).”

Let’s look at the difference in costs for an employer to contribute $100 to a student loan versus an employee to contribute $100:

As we saw above, an employer that adopts a Section 127 plan may exclude its contributions to student debt from the employee’s gross income. Therefore, the employer’s cost to make a $100.00 contribution is $100.00.

However, even if the employer adopts a Section 127 plan, an employee may only pay down his/her student loans with after-tax dollars. In order for the employee to take-home $100.00 that she would then contribute toward her student loan, she would need to earn $142.21, then have $24.22 withheld from her paycheck for Federal Income Tax, $8.82 for Social Security, $2.06 for Medicare, and $7.11 for State Income Tax.

Whether the employer contributes to student loans on a taxable basis outside of a Section 127 plan, or on a tax-free basis through a Section 127 plan, employees may only contribute to student loans with after-tax dollars. Effectively, it is

about 40% more tax efficient for employers to contribute to student loans than it is for employees.

Many Americans burdened by student debt, and unable to pay it down in a tax-efficient means, are likely to request that their current or future employer help pay down their loans.

III. How Student Loan Assistance helps employers attract and retain college-educated workers

Student debt is pervasive: Today, more than 45 million Americans collectively hold over $1.5 trillion in student debt. Over the last 15 years, student debt has outpaced disposable income five times.

It’s a serious problem for employees: 51% of student loan holders say their debt is ruining their quality of life. Across the U.S., student debt is delaying the American Dream, and preventing people from buying homes, cars, saving for retirement and getting married.

As we enter an era of economic uncertainty brought on by the coronavirus pandemic, the burden of student loans becomes even more crippling.

Student Loan Assistance helps employees get out from under student debt faster:

Student Loan Resources

Advice, counseling, and refinancing

Student Loan Repayment

Monthly Contributions

By leveraging Peanut Butter’s Student Loan Assistance platform, employees gain access to the resources they need to manage their student debt, and companies can contribute to the repayment of student loans.

As a taxable benefit, Student Loan Repayment offered a proven strategy to help employers hire faster and retain talent longer. The Millennial Benefit Preferences Study found that when companies offer Student Loan Repayment, there is a:

- 13% increase in willingness to accept an offer, and

- 36% increase in willingness to stay with an employer.

In 2019, the Society for Human Resources Management (SHRM) reported a 100% year-over-year increase in the number of employers offering Student Loan Repayment. As a tax-free benefit, Student Loan Repayment will yield even greater results for employers, and will continue to be rapidly adopted by employers looking to attract and retain college-educated workers.

In today’s economy, Student Loan Repayment can be especially impactful for:

Employers of Essential Workers

- 30% of those employed in Health Care hold student debt

- 23% of those employed in Retail & Wholesale hold student debt

Employers of the Highly Educated and Highly Indebted

- 34% of workers in Professional Services hold an average of $39.1K in student debt

- 34% of workers in Education hold an average of $49.3K in student debt

- 32% of workers in Technology hold an average of $32.7K in student debt

Employers that have downsized and need to retain critical staff

- 26% of those employed in the U.S. Workforce hold student debt

As U.S. employers prepare to return from quarantine and ramp-up operations, it will be even more important to deliver the incentives that matter to the workers they need.

IV. Student Loan Assistance program design considerations and FAQs

Prior to the CARES Act, the three most popular Student Loan Assistance program designs were:

1. Student Loan Resources + $50/month contributions

2. Student Loan Resources only

3. Student Loan Resources + $100/month contributions

These program designs are expected to remain the most popular now that employers can contribute tax-free.

Student Loan Resources serves as the foundation for all Peanut Butter Student Loan Assistance programs. 70% of student loan borrowers don’t know how to find out if they could be paying less. With Student Loan Resources, employees have a single place to organize their loans and view up-to-date information, a pay-down visualizer that models-out repayment scenarios, and can learn about and implement tactics that can save them money on their existing loans. Student Loan Resources also includes access to Peanut Butter’s Refinancing Marketplace, where employees can receive quotes from national and community lenders in just a couple of minutes, without the need for a credit check. Once they’ve mastered their student debt, employees can make use of financial wellness modules to help with their next hurdle, such as maintaining their credit score or saving for the down-payment on a home.

When companies offer Student Loan Repayment, employees get out of debt faster and typically stay with the company longer. This helps employers reduce the costs of lost productivity, rehiring and retraining that would otherwise come with employee turnover. And employer’s don’t need to contribute a lot. The most popular contribution is just $50/month. Employers have realized that they are competing for talent, not based on how much they contribute, but on whether they contribute at all. With a $50/month contribution, an employer can help the average student debtor get out from under her loans in eight years instead of 10, and save close to $7,000 in principal and interest.

There are four key questions employers should answer when deciding to offer Student Loan Assistance:

1. Will the company contribute to the repayment of employees’ loans?: For companies focused on attracting and retaining workers, the answer will be yes. If the company is simply looking for a low-cost way to engage college-educated talent, it may choose to just offer Student Loan Resources.

2. If so, would the company like to make its contributions tax-free?: For most employers, the answer will be yes. In order to offer tax-free Student Loan Repayment, employers will need to adopt a Section 127 plan (or amend a Section 127 plan if one already exists). To qualify under a §127, a program must:

- Have a written plan document.

- Not provide more than five percent of its total annual benefits to individuals who own more than five percent of the company’s stock.

- Not provide eligible employees with a choice between educational assistance benefits and any other taxable compensation (whether cash or non-cash).

- Provide eligible employees with reasonable notification of the availability and terms of the program.

- Benefit employees in an employer-designated classification that does not discriminate in favor of highly compensated employees. An employee is a highly compensated employee, for purposes of §127, if the employee meets either of the following criteria:

- Owned at least five percent of the employer’s stock in the preceding or current calendar year

- Received compensation from the employer in the preceding year in excess of a specified amount determined annually by the IRS.

If the program meets these criteria, employers can provide employees up to $5,250 in educational assistance benefits each year on a nontaxable basis. The exclusion applies whether or not the courses taken are related to the employee’s current job responsibilities or are part of a degree program.

3. And, will all full-time employees be considered eligible for student loan repayment?: For most employers, the answer will be yes. This is not only the most popular approach that employers take, but is also the most simple way to maintain compliance with the nondiscrimination rules included in §127 (described above).

Note: eligibility is determined by the sponsor of the benefit plan regardless of whether the employee holds student debt. If an eligible employee does not hold student debt she will simply elect to not participate in the Student Loan Repayment plan. This is similar to how an employee can have the option to decline coverage in an employer’s health plan.

Some employers, however, will prefer to focus their benefit spend by restricting eligibility to a subset of employees. So long as the definition of eligibility does not favor Highly Compensated Employees (HCEs), including those who earn more than $125K annually, officers of the company, or individuals that own more than 5% of the company’s stock, an employer may choose to restrict eligibility by any of the following means:

- By job level (i.e., you’re eligible if you are manager-level or below)

- By job type (i.e., you’re eligible if you are a nurse)

- By division (i.e., you’re eligible if you work customer service)

- By location (i.e., you’re eligible if you work in the field, but not at corporate headquarters)

- By salary (i.e., you’re eligible if you make $75K or less)

- By tenure (i.e., you’re eligible if you’ve been with the company for 1 year or more)

- Tiered by tenure (i.e., you’re eligible for $50/month when you start with the company, $100/month after a year of service, and $200/month after 2 years of service)

Many employers will choose to self-test for compliance with the nondiscrimination rules included in §127. Section 1.127-2(d) of the Income Tax Regulations incorporates the minimum coverage requirements of section 410(b)(1)(B). There are two possible 410(b) tests, the simpler of which is the ratio test. It compares the percentage of non-HCEs (NHCEs) benefiting to the percentage of HCEs benefiting. It looks like this:

(# NHCEs eligible / # total NHCEs) / (# HCEs eligible / # total HCEs)

This ratio must equal or exceed 0.7.

So, for example, if a company has:

- 1,000 employees of whom 80 are HCEs, and

- 300 nurses of whom 10 are HCEs, and

- The company wanted to offer student loan repayment tax free to only it’s nurses, then

The ratio test is calculated as (290 NHCE nurses eligible / 920 NHCEs total) / (10 HCE nurses eligible / 80 HCEs total) = 2.52. Since the ratio exceeds 0.7, the plan is in compliance.

4. And, how much will the company contribute?: For most employers, the answer will be $50 / month (as described above). Technically, employers could work with Peanut Butter to contribute as little as $1 / month or as much as millions; however, as a practical matter, employers typically contribute no less than $30 / month and seldom more than $100 / month. Employers that choose to contribute under a Section 127 plan may exclude up to $5,250 from the employee’s gross income and would need to report any amount above $5,250 as taxable compensation.

There are a couple of key reasons why employers choose to contribute monthly:

1. Leverage: The company can hold onto its cash longer than if it were to contribute in an up-front lump sum. And employees only receive contributions when they stay with the company.

2. Employment brand: Few benefits provide for a consistent and positive reminder of the company’s impact on an employee. When employers contribute, Peanut Butter confirms the payment and quantifies the impact to the employee each month, reinforcing the advantage of employment.

FAQs:

1. Can employers continue offering taxable Student Loan Repayment?

Yes, employers are still able to offer Student Loan Repayment as a taxable contribution. This can be valuable for employers that choose to restrict eligibility to a subset of their population that over-indexes for HCEs.

2. Are employer contributions to student loans 100% tax-deductible as a business expense?

Yes, both for tax-free (Section 127) and taxable (outside Section 127) Student Loan Repayment plans.

3. Can section 127 plans apply to 1099 contractors?

Yes, the company would pay the full amount and the self employed individual would be responsible for adopting her/his own Section 127 plan.

4. If our company currently offers Student Loan Repayment and adopts a 127 plan effective 3/27/2020, when the CARES Act went into effect, can we reverse out taxes that were withheld on March 31st paychecks?

Yes, it appears that your company can make its plan retroactive, thus, any contributions that were recorded after its effective date may be excluded from the employee’s gross income.

5. Does my company currently have a Section 127 plan?

Maybe. Prior to the CARES Act, Peanut Butter would not have had a reason to know if you had a Section 127 plan in place. If your company offers Tuition Reimbursement, then it probably has a 127 plan. If not, then it probably doesn’t. The best place to check is with your legal department. If you determine that your company does have a Section 127 plan already, Peanut Butter clients can incorporate Student Loan Repayment using our Sample 127 Amendment. If you don’t have a Section 127 plan, Peanut Butter clients can adopt a new Section 127 plan using our Sample Plan Document.

Once you have either incorporated Student Loan Repayment into your existing 127 plan or adopted it into a new 127 plan, then you can begin excluding the company’s Student Loan Repayment contributions from the employee’s gross income.

6. What loans qualify for Student Loan Repayment?

Federal and private student loans qualify for tax-free contributions under a section 127 Student Loan Repayment plan so long as the loan was taken out for the employee’s own college tuition and related expenses. These loan types include:

- Direct Subsidized, Unsubsidized, Consolidation, and Grad Plus loans

- Stafford Subsidized, Unsubsidized, Consolidation, and Plus loans

- Perkins Loans

- Private Student Loans

Unfortunately, student loans taken out for the benefit of an employee’s dependent, spouse, or another person do not qualify for tax-free employer contributions under section 127. Therefore:

- Direct Parent Plus loans will not qualify for tax-free contributions,

- Private parent loans will not qualify

- Co-signed loans will not qualify

- Any non-student loan will not qualify (e.g., credit cards, home equity loans, personal loans, etc.)

7. Is it true that the CARES Act has only authorized tax-free employer student loan payments until the end of 2020?

Yes. Under the CARES Act (H.R. 748, specifically Sec. 2206(B)), employer contributions to student loans may be excluded from the employee’s gross income up to a maximum of $5,250 for payments recorded on payroll up to and including December 31, 2020, when the employer has adopted a Section 127 plan.

It is Peanut Butter’s opinion that bicameral, bipartisan support for this measure, currently in writing by a majority of Congressional members, indicates a high likelihood that the tax-free treatment of employer-sponsored student loan contributions will be extended beyond 2020.

Section 2206(B) of the CARES Act was adopted verbatim from the Employer Participation in Repayment Act (H.R. 1043/S. 460). Each of these bills has been referred to committee and each currently has co-sponsorship from a bipartisan set of members representing over 60% of the relevant chamber of Congress.

8. If our company has an existing 127 plan, does the $5,250 limit apply separately for Tuition Reimbursement and Student Loan Repayment, or is $5,250 an aggregate limit for all Educational Assistance that can be excluded from gross income?

Aggregate.

9. Can employees also make payments through a Student Loan Repayment plan?

No. The CARES Act does not allow employees to contribute to student loans tax-free. Employers should not attempt to process employee student loan payment through a payroll deduction because (1) it would disadvantage the employee by negating the option loan servicers provide for a direct debit discount, and (2) it would make the employer liable for penalties and late fees in the event of a short or late payment. Learn more here.

10. Is there a way for our company to offer Student Loan Repayment without incremental cost?

No. When the company offers tax-free Student Loan Repayment, it needs to be offered in addition to any cash compensation or other benefits. The reason that companies choose to invest in Student Loan Repayment is to differentiate in the market for talent and improve employee engagement, thereby reducing the costs of talent acquisition and the costs of employee turnover.

11. Can our company offer employees the option to either receive cash or receive tax-free Student Loan Repayment?

No. Section 127 of the tax code very clearly states that “To qualify under Section 127, a program must not provide eligible employees with a choice between educational assistance benefits and any other taxable compensation (whether cash or non-cash).” Doing so would create a constructive receipt issue.

12. Can our company include tax-free Student Loan Repayment in a Section 125 cafeteria plan?

No, not as a tax-free 127 plan, but yes as a taxable benefit.

13. Can our company offer employees the option to either receive 401(k) contributions or receive Student Loan Repayment?

No. This would violate ERISA’s Contingent Benefit Rule, regardless of whether the company offers taxable or tax-free Student Loan Repayment.

14. How do employers typically fund their Student Loan Repayment program?

There are several ways companies can fund employer-sponsored Student Loan Repayment:

- Recruitment Savings: Companies that are hiring especially essential workers can reduce the cost of talent acquisition by offering a more material benefit package, improving the offer acceptance rate and reducing the number of job candidates that need to go through the funnel.

- Retention Savings: Employee retention savings are relevant for any company that needs to retain critical staff, or any company that has a highly educated and highly indebted workforce.

- Shift Budget Dollars From Less Impactful Benefits: The Millennial Benefit Preferences Study found that college-educated workers would value $1.00 paid toward their student loans the same as $2.00 paid towards insurance or retirement, and the same as $7.00 paid toward common perks or benefits.

- CARES Act Provisions: There are a number of short term provisions under the CARES Act that may provide funding options for a Student Loan Repayment benefit, including the option for employer Social Security deferrals.

V. Peanut Butter makes it easy for employers to offer Student Loan Assistance

Peanut Butter’s comprehensive Student Loan Assistance platform provides a digital enrollment for Student Loan Repayment, complete with loan verification, support, payment remittance and tracking/reporting, while also providing employees/borrowers with financial wellness tools to optimize their loans.

Employers may begin offering Student Loan Assistance in a few simple steps:

1. Setup your company’s Student Loan Assistance program: In 15 minutes online, an employer of any size may create their Peanut Butter account, set up one or more Student Loan Repayment plans, and schedule a Program Initiation Call with their Peanut Butter Customer Success Manager. During the 45-minute Program Initiation Call, we’ll review the account and plan setup, review the on-demand reporting available to employers, walk through the monthly administrative process, discuss communications best practices and go over the Program Administrator Toolkit.

2. Optional: Incorporate Student Loan Repayment into a Section 127 plan: If the employer would like to offer tax-free Student Loan Repayment, the company will either need to amend its existing Section 127 Educational Assistance plan to include Student Loan Repayment, or adopt a Section 127 plan. Included in the Program Administrator Toolkit, all Peanut Butter clients receive a sample Section 127 plan document that can be used to establish a new Section 127 plan, or a sample 127 plan amendment to incorporate Student Loan Repayment into an existing 127 plan. The relevant sample document should be reviewed by the company’s legal counsel and will need to be signed by an officer of the corporation. Employers that would like to offer taxable Student Loan Repayment are not required to adopt a plan document.

3. Initiate enrollment: In a few clicks of the mouse, employers may initiate enrollment. Employees may enroll online in about five minutes, and can call or email Peanut Butter with any questions that might arise. Going forward, a member of the company’s HR department will follow our streamlined process to record the company’s contributions tax-free. This process typically takes 30 minutes or less each month.

Clients

If you are currently offering Student Loan Resources or Student Loan Repayment and would like to enable tax-free contributions, check out your Program Administrator Toolkit for a sample 127 plan document. Once you’ve adopted the plan, your contributions can then be excluded from the employee’s gross income.

Employers

If you’d like to set up a Student Loan Assistance program for your company, click here to Get Started.

Brokers & Partners

If you’d like to help a client set up a plan or receive a proposal, click here to Get Started.