***Updated December 7, 2022***

On Wednesday, August 24, 2022, the White House announced President Biden’s Student Loan Relief Plan. The three-part plan includes:

- $10,000 of potential debt reduction for federal loan borrowers and the payment holiday’s end (hereafter referred to as “Debt Reduction & Payment Resumption”),

- Structural changes to Income-Driven Repayment (IDR) plans and administrative changes to the Public Service Loan Forgiveness (PSLF) program, and

- A plea for colleges to work on reducing or maintaining tuition prices.

In this article, we’ll focus on how the Debt Reduction & Payment Resumption component of Biden’s plan is expected to impact employees as student loan borrowers, employers as sponsors of existing student loan repayment plans, and employers looking to offer student loan repayment in the future.

Employees

How will Debt Reduction & Payment Resumption affect borrowers?

The most important thing for borrowers to remain conscious of is that their student loans still exist and there’s no guarantee that any specific loan will be forgiven. Unfortunately, programs like this one have a poor track record:

In 2008, the Obama administration announced the Public Service Loan Forgiveness program and in 2019 a meager 1% of applicants had their loans forgiven. Over those 11 years, many public servants who thought they were going to have their loans forgiven accrued penalties, and interest, and damaged their credit by not making payments. This is an age-old lesson: don’t count your chickens before they hatch.

So, if your loan servicer says that a payment is due now, next month, or any time in the future, you are responsible for paying that amount by the date it is due.

Here’s the bright side: President Biden’s plan is for the US Department of Education (DOE) to forgive up to $10,000 in federal student loan(s) for borrowers earning less than $125,000/year and up to $20,000 if the borrower received a Pell Grant. But, like earning your college degree, you’ll need to work for this debt reduction. To receive the reduction, borrowers will need to submit an application proving that they qualify, wait to have their application approved, and applied to the loan. Here’s the current guidance from the DOE.

The application will be made available by the US Department of Education (DOE) and distributed by each of the federal student loan servicers (e.g., Aidvantage, MOHELA, Nelnet, Great Lakes, Fedloan, Edfinancial, OSLA). Borrowers may signup here to receive an email from the DOE when the application is available (check ‘Federal Student Loan Borrower updates).

Once the application is available, you submit your application, and your application is approved, you’ll know your debt has been reduced when your loan servicer shows the reduction is applied. If your loan is fully paid off, you should also request a letter from the loan servicer confirming that the loan has been fully repaid. If you are participating in an employer-sponsored Student Loan Repayment plan, you’ll then log in to Peanut Butter and mark your loan as paid off. If you have another student loan that qualifies for the program, you can switch contributions there, or you can confirm that all of your student loans are now paid off, and you’ll graduate from the program.

Unfortunately, several details remain unclear:

- What types of loans will qualify for relief? We believe that Direct Subsidized, Unsubsidized, Consolidation, Grad Plus, and Parent Plus loans will all qualify for Debt Reduction. It’s unlikely that Perkins loans will qualify. And we believe that Stafford loans will not qualify. Private student loans definitely will not qualify. Of course, student loans that don’t currently exist are also unlikely to qualify; while grads and college students may benefit from this debt reduction, children, high school students, and families that plan to use student debt to pay for higher education in the future will not see a benefit.

- Which loans will be reduced first? We hope each borrower will have the option to determine which loan(s) would be reduced first; however, this probably won’t be the case. For example, one borrower might like to have $10,000 reduced from the balance of her Direct Unsubsidized loan because it has a higher interest rate than her Direct Subsidized loan, whereas another borrower might prefer to have $10,000 reduced from his Direct Grad Plus loan because it has a higher balance than his Direct Consolidation loan. As Peanut Butter users know, excess payments to student loans get applied based on the terms of the loan agreement and the loan servicer’s policies. Some loan services accept directions from borrowers, so all Peanut Butter users are encouraged to review their Target Payments Action Item.

- When will loan balances be reduced? There is no definite timetable. President Biden’s plan states that the DOE will make applications available by 12/31/22, but offers no guidance on how long it will take for applications to be reviewed, how debt reductions will be communicated to loan servicers, or when debt reductions will take effect.

- Will Biden’s Plan be enacted? It’s not a sure thing. According to the Wall Street Journal, President Biden’s plan will “test the legal limits of the federal government’s authority to cancel debt”. Numerous representatives in the House and Senate have already spoken out against the plan. Since being announced, the plan has been contested in court and is scheduled to be heard by the US Supreme court starting in February of 2023.

One thing is very clear. The payment holiday on federal loans that began in March 2020 allowing borrowers to forgo payments and not accrue interest will end in 2023. According to DOE, the holiday will end 60 days after the pending litigation is resolved, or August 29, 2023, whichever is sooner. While each borrower’s monthly payment will differ based on her balance, interest rate, and amortization schedule, the average student loan borrower will be required to pay about $250/month once payments resume.

Employers

How will Debt Reduction & Payment Resumption affect employers offering Student Loan Repayment?

In the coming days and weeks, President Biden’s plan will have no impact on employers currently offering Student Loan Repayment. At this time, no loans have been forgiven, no application is available, and if any given loan is to be forgiven, it will require action by the borrower/employee and processing time for the DOE and loan servicers.

As Peanut Butter users, employees can find information about Debt Reduction & Payment Resumption, or by logging into Peanut Butter and clicking on the Learning Library or Help Center:

- Learning Library: President Bident’s Student Loan Relief Plan

- Learning Library: Federal Loan Interest Waiver

- Help Center: How may I receive loan forgiveness announced by President Biden?

Of course, Peanut Butter users are welcome to contact our Support Center at support@getpeanutbutter.com or 800.913.6651 (press 1 for participant support).

Once the DOE makes its Debt Reduction application available, eligible borrowers will be contacted by their loan servicer with information on how to apply. Peanut Butter will also make this information available to users. Before payments resume on Federal loans in January, borrowers will be contacted multiple times by their loan servicer advising them of their payment amount and due date.

Assuming President Biden’s plan is enacted, employee participants in student loan repayment plans will either:

- Have all of their loans forgiven and graduate from the program.

- Have some of their loans forgiven and remain enrolled in the program.

- Have no loans forgiven and remain in the program.

According to the DOE, about one-third of student loan borrowers currently hold less than $10,000 in student debt. So, employers can expect that about one-third of their participants will graduate over the next 6 months or so, as loans are forgiven. This will, in turn, reduce the company’s program cost by about 33% for 2023. For borrowers that remain enrolled (and new enrollees), many now with lower balances, the impact of the employer’s contribution will be that much greater – helping the employee get out from under her debt even faster than before.

As Peanut Butter clients know, we offer a smooth process to support borrowers paying off their loans. The borrower can mark the loan as Paid Off in her Peanut Butter account and easily switch contributions to another student loan without interaction with the employer. If all loans are paid off, the employee will confirm her “graduation” from the student loan assistance program, and Peanut Butter will return overages directly to the employer along with an Honorary Peanut Butter Diploma for the worker.

Employers

Is now the right time to begin offering Student Loan Repayment?

Absolutely. The market for talent has never been so hot. It remains a candidate’s market and employers seeking to attract the best and brightest need a way to stand out. President Biden’s Debt Reduction Plan is another example of how organizations are deploying modest incentives against student debt to convince individuals to take action. Companies offering student debt are able to hire 13% faster and retain talent 36% longer.

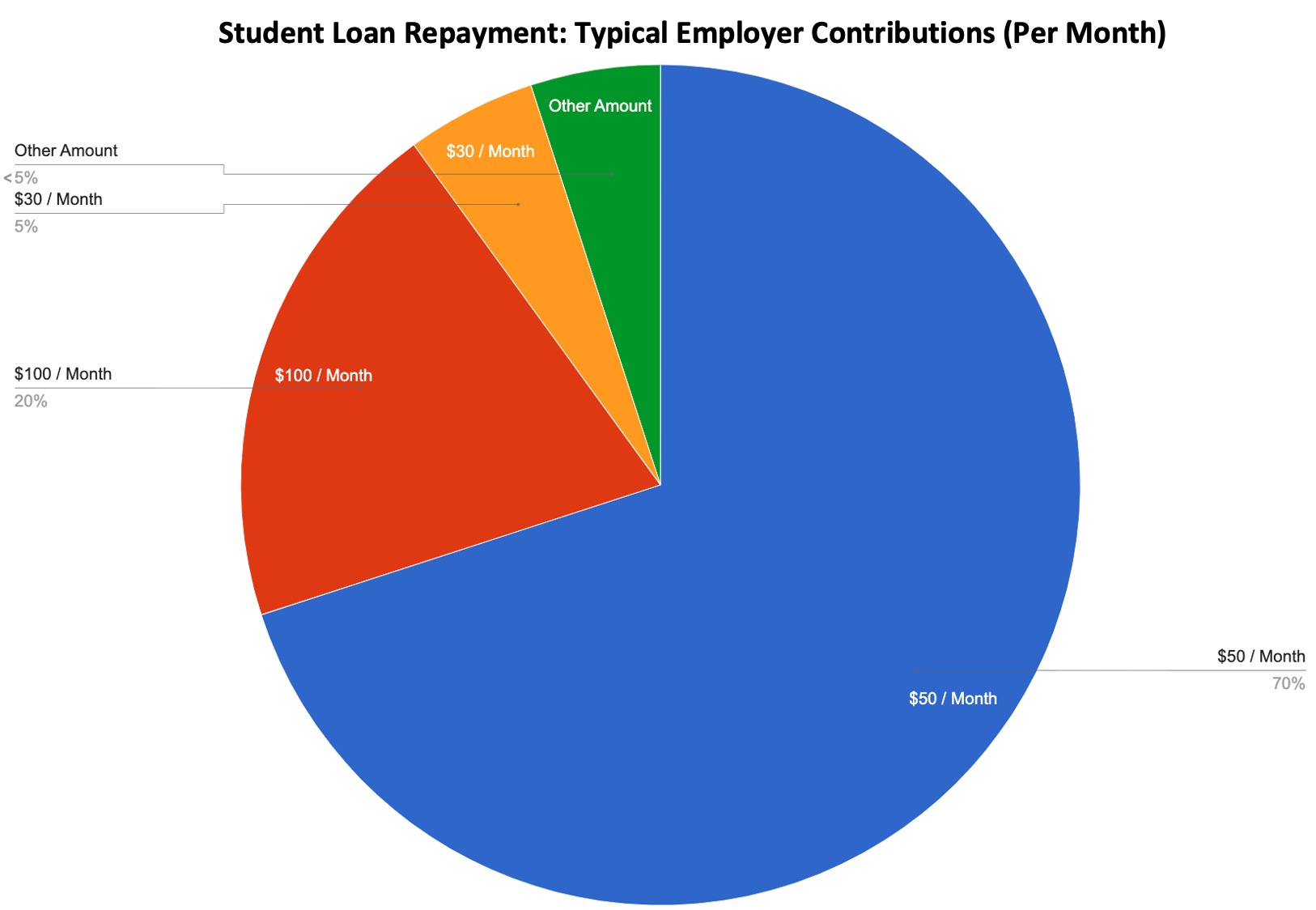

Student Loan Repayment: Typical Employer Contributions (Per Month)

In 2023, we expect that contribution amounts will remain constant. Employers have normalized contributions through simple, yet effective plans. Today, about 70% of all employers contribute $50/month. Another 20% contribute $100/month, 5% contribute $30/month, and fewer than 5% contribute another amount. Employers have largely moved away from holding periods and tiered plans, most making the benefit available from the date of hire and in a flat amount for all eligible employees. And most employers are choosing to offer their program on a tax-free basis.

Our recommended plan design headed into next year is:

- $50/month tax-free, from the date of hire, for employers of all sizes and in all industries, or

- $100/month tax-free, if most of your employees are in an area with a high cost of living (i.e., NYC, LA, SF), or most of your employees have advanced degrees (i.e., dentists, veterinarians, attorneys).

Participation in Student Loan Assistance programs will be lower in 2023 once President Biden’s Debt Reduction plan is enacted because roughly ? of today’s student loan borrowers will become debt-free; accordingly:

- Employers offering $100/mo in repayment are likely to see 20% participation down from 30% historically

- Employers offering $50/mo in repayment are likely to see 17% participation down from 25% historically

- Employers offering $30/mo in repayment are likely to see 14% participation down from 21% historically

- Employers offering Resources Only are likely to see 5% activation down from 8% historically

- Employers offering Refinancing Only are likely to see 1% utilization down from 2% historically

With the cost of offering Student Loan Repayment dropping by 33%, 2023 is a great time to begin offering the benefit. After nearly 3 years of $0/month payments due to the Federal Loan Holiday, January will be a wake-up call for many student loan borrowers who need to begin making payments again. Employers who help will reap the benefits of shorter hiring timelines and longer employee tenure. Plus, the contributions employers make to employee loans will be even more impactful than before, since federal loan balances will be slightly lower due to the Debt Reduction.

To get your company’s student loan assistance program started, click here.